by Mike –

The My Car Quest Classic Car Value Survey was posted a few days ago and the results are in and tabulated. My thanks to all who participated.

When measuring the overall economy the actual results can be driven by the feelings and attitudes of the people. This is also true for the classic car collector economy. If everyone is bullish then car lovers will be more likely to buy a car. Or, sell one they have now and trade up for something else that they want more.

On the other hand if the majority believe that the classic car values are stagnant or down then they may be likely to hang on to their car and wait for a better market.

Let’s see how the My Car Quest readers feel about the condition of the classic car market today.

I have opened the envelope and here are the results!

1) Do you believe that the classic car value trend is:

Up – 82%

Down – 3%

Flat – 10%

Do Not Know – 5%

2) Do you think that the values for classic cars below $500,000 are increasing similar to classic cars valued at more than $5 million?

Yes – 35%

No – 55%

Do Not Know – 10%

3) What do you think is driving the increase in classic car values? Check all that apply.

Investment diversification – 25%

Classic cars are a better investment than the stock market – 18%

Classic cars are a more stable investment than alternatives – 16%

The fun factor of owning a classic car compared to owning stocks or bonds – 41%

4) Do you think that classic car investment funds are good for classic car collectors and enthusiasts?

Yes – 14%

No – 51%

Do Not Know – 35%

~~~

What conclusions can we draw from the survey results?

A. The market is strong and values are going up but the multimillion dollar market may be increasing in value more that the lower value classic car market.

B. The market is driven mainly by the fun factor of owning a classic car that you can use instead of boring stocks and bonds.

C. The majority do not like the idea of classic car investment funds. This conclusion supports owning a car for the fun factor because in a classic car fund the investors in the fund do not get to enjoy the cars owned by the fund.

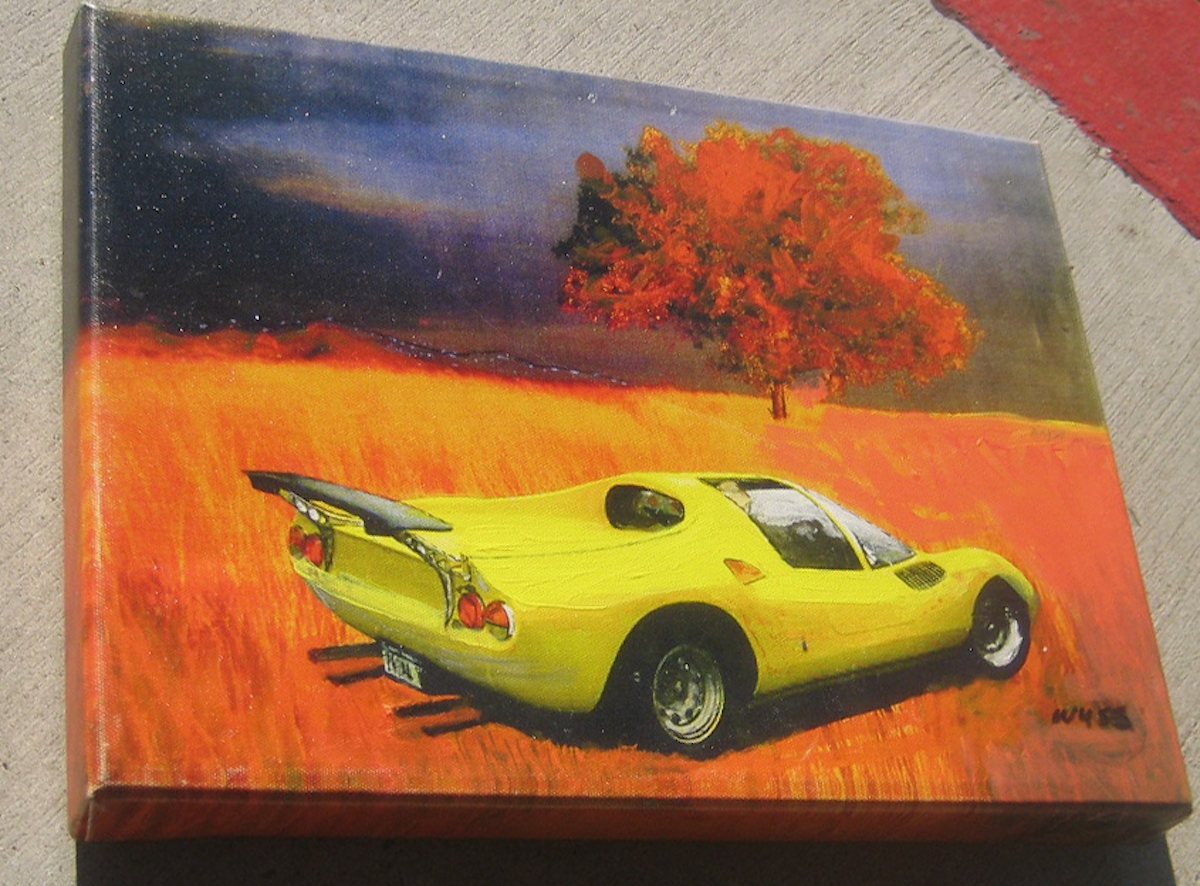

I still wonder who will pay more that $35 million for a Ferrari GTO. I think it is possible that the buyer of that GTO does not care about its investment potential and he has that luxury. But at some point someone will actually care about the value, maybe an heir.

Let us know what you think about the survey results in the comments.

Buy one of my eBooks at the Amazon links below.

Subscribe to My Car Quest

More than one Ferrari GTO has sold for more than 30 million…in fact several if you are to believe the small exclusive “club of owners”, many members of which are definitely reputable sources. Here, as opposed to auctions, private sales are the norm, for there is such a limited supply one needs only to make it known to the “club” that your car may be for sale and potential buyers will appear. And as long as there are more eager buyers than cars, the price will continue to rise. Hard to believe at these numbers, but true.

As you remember, in 2011, there were 22 GTO’s gathered at Pebble on Sunday, and many of them were raced at The Historics on Saturday (the day before) which is a testament to the owner’s passion. If you were lucky enough to see the race (dedicated to vintage Ferrari 250 models) you will remember most of the pack racing flat out…an extraordinary spectacle. So you are right Mike, most of these gentlemen enjoy these incredible cars for what they are…not just the investment. And of course they are also able to afford them. Suffice to say you probably won’t see any “investment grade automobile funds” racing their assets like there was no tomorrow.