by Mike –

The following are my observations on the classic car market over the past 1-2 years:

* Some classic cars are taking longer to sell, probably due to a too high asking price

* The top classic car auctions are bringing cars to their auctions they would not have brought in the past because they cannot get the top cars they really want (although the Monterey line up this year looks interesting so far)

* Some owners of special classic cars are not selling them now – maybe they are waiting for higher prices?

* The auction sale rates are lower – a likely contributor is higher than the market will bear reserve prices

The Maserati Ghibli Coupe above did not sell at the Bonhams auction in Monaco on May 13 with an estimated price range of €320,000 – 380,000 (US$ 350,000 – 420,000).

The 1965 Lamborghini 350 GT above did not sell at the Gooding auction in Amelia Island on March 11 with an estimated price range of $675,000 – $775,000.

Below is from the experts at the Hagerty Price Guide.

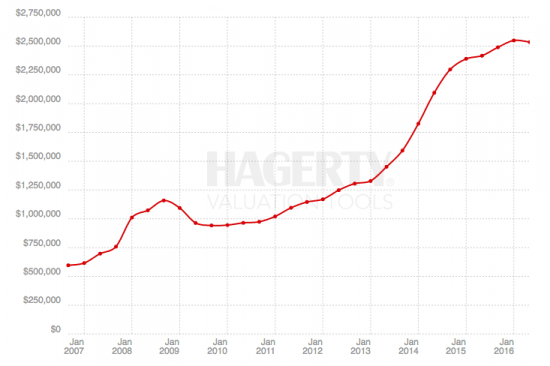

From the Hagerty Blue Chip Index,

Following six years of unabated gains, the Hagerty Blue Chip Index recorded a loss. This marks the first time this collection of cars has slipped since September of 2009, at which point the economy was still feeling the effects of the Great Recession and the collector car market was at a low. This time around the American economy is in better shape but global unease is high and the effects are apparent at the top of the market.

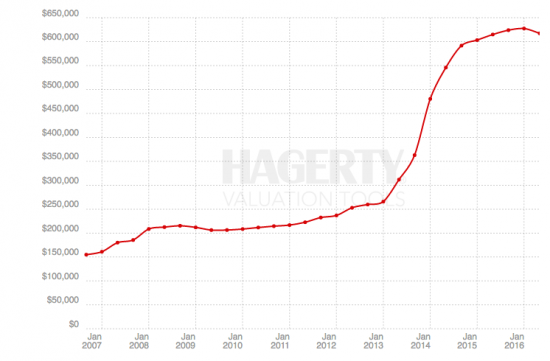

From the Hagerty German Collectibles Index,

The Blue Chip Index, Ferrari Index, and German Car Index make up the “Big Three” of Hagerty’s seven primary indices, and like the other members of this group, the German Car Index lost ground for the first time since May 2009. Even though the loss was a minimal 2% drop, it is the largest decline of Hagerty’s primary indices. What is particularly striking here is that this segment of the market has been historically insulated from downshifts—of the 29 periods since the index’s inception date, it has only logged 3 downturns in value.

The 1968 Ferrari 275 GTS/4 NART Spider by Scaglietti above did not sell with an estimate of €19,000,000 – €23,000,000 at the RM Sotheby’s auction in Monaco on May 14.

Summary

This may be a good time to seek out that special car you have been wanting because, in my opinion, we are in a buyer’s market. A buyer’s market is only meaningful if the seller is selling and is not meaningful for all cars.

If you are a seller you may have to accept a lower price than you anticipated or hold on and wait for the next up cycle which will start at some point in the future.

Let us know what you think in the Comments.

A strong viable market for any product or service is only sustainable over the long term when there is a sufficient imbalance between supply and demand that enables it to be consistently ‘demand led’. In the classic car sector this ‘demand led’ scenario eventually led to the auction houses building a business model that was heavily loaded with fixed expenses, the imbalance between supply and demand inevitably changing to become ‘supply led’ – culminating in the last two years with an endless stream of auctions, all gradually reducing their quality standards (the cars) to meet the revenue turnover necessary to cover their high expense base. Add to that a supply side (the car owner) with expectations built on past results and a natural if pathological resistance to disappointment (what his car is really worth) creates the dynamic for a market reset. Which as Mike suggests we can call “soft”!

I don’t think the market is soft and the entry level investment car is certainly now north of 40k. We have seen the average cars take a drop in the mid-2000 but the unique rare low production cars are still a good investment. Seller expectations is certainly high and certainly there are some do not meet reserve at auctions, but that does not mean they did not sell. There is unfortunately no measurement for the off auction transaction: private deal and specialty seller stores. The market has certainly changed and both auction houses and speculators will need to change the game but there are plenty of new opportunities. The classic collectors are getting up in age and they have started to sell their less unique and less perfect cars at the same time the demand is shifting to newer vintage. Look at 308’s, air cooled 911, 70s BMW, NSX’s, 240z, early Bronco, FJ40 to name a few.

Good points all. There is a changeover taking place in owners. I can tell that when I go to a Porsche 356 event, many owners are baby boomers who bought their cars 20,30 and 40 years ago. They are beginning to “cash in” (albeit reluctantly) so they can buy their retirement homes, etc. The new owners pour money into restoring them and the asking prices go ever higher (like one million for a Carrera Speedster!)

I think that the one thing neither commenter touches so far is the rising-tide-lifts-all-boats effect of newcomers from heretofore unknown collector markets bellying up to the bar with open wallets. Consider the fact the first concours are being held in the Middle East like Dubai. Some of the newcomers there are sitting on oil revenues that bring them millions per day, so as they get more interested in appearing at concours they will come in, with advisors from Britain (usually) helping them not just buy on emotion but provenance. Not only that, there’s oligarchs from Russia. I have heard of them buying yachts but not classic cars but if they have a mind to, they could. So if they come in and buy 30-50 top end sports cars, it could cause a boom. I remember when a 390-foot super yacht, the aquatic toy of Russian billionaire Andrey Melnichenko was spotted off Malibu. It was far too long to dock at their measly little pier! That was the first time American movie stars living in Malibu could look out on the ocean and see REAL money. .

i saw this with sunbeam tigers 25 years ago you could buy a good tiger for 4-6000gbp then bang you could not get half decent one for less than 10,000 this then went to a high of 20,000 for mk 1 and one of the last right hand drive cars (mk 2 cars) i know sold for 30,000gbp the same price as 4 year old Porsche 911 turbo, then bang cars went down and all the big boys where trying to dump their classic and tigers where one of them,average price for a nice tiger dropped back down to 10-12000 mk2 a little more,i knew of many American that where spending in excess of 100000usd restoring tigers only to see a glut in the market and 3/4 of that value vanish,what i learnt from this if you are buying a classic buy it for what it is a toy to be enjoyed,they are not very good to live with on a day to day basis but when they are on song there is nothing better,remember this if we are in a downward spiral its a good time to buy this will last a few years(normally a 6 -8 year cycle) then all of a sudden they will return with market forces very similar to house valuations, but buy wise choose a car that you want to own that you are passionate about my love was sunbeam tigers but after living with them for over 20 years i decided to sell up and buy the car i thought i could never afford to own a Jensen interceptor convertible,and if you no good with the spanners they will be a pain anything British/Italian//American,they have got built in faults buts that the pleasure in my case and always something to do ,why would i pick a interceptor it breaks all my rules,its British built /Italian styling and American engine but i went in one when i was 12 and the noise the smell of the leather and its Italian styling i was smitten,so remember when you go to look at buying a classic if you don’t look back at it when you park it up you got the wrong car!!

…. “If you don’t look back at it when you park it up, you got the wrong car”

Mate, there ought to be a song in that.

It is something that I find I invariably do, even when I move them around the workshop, yet never thought about it.

Thanks for the insight. Most amusing

Many thanks very interesting. I would appreciate thoughts on the topic of how online presentation and exposure has changed the negotiating process. Also any thoughts on the market for storage. Not many people have the space of Jay Leno’s garage. Thanks.