by Mike Gulett –

The Monterey auctions, which were held recently, are arguably the most important in the worldwide collector car market. There are a spectrum or cars put up for auction every mid-August during Monterey Car Week from modern exotics, rare European cars (Ferrari is the leader in this category), to American muscle cars and hot rods. The sellers and the buyers come from around the world.

After reviewing the results of the major auctions during Monterey Car Week I think we are in a classic car market down turn. This does not apply to all classic car categories or models but I see signs it is happening, or has already happened.

My opinion is not based on a detailed analysis of the auction results (I will leave that to Hagerty, Sports Car Market and others) but it is based on my reviewing the auction results of: RM Sotheby’s, Gooding, Mecum and Bonhams. I suspect the total value of all cars sold this week will be lower than last year, the sell through rate will be lower and the average sales price will be down as well.

I noticed that many of the cars that did sell were sold below the low end of the estimate. This means that the sellers and the auction companies were a little too aggressive on setting expectations and setting the reserve prices.

The total value of all cars sold and the average sales price are certainly a function of the cars brought to these auctions and not just the buyer’s willingness to pay for more expensive cars. The sales prices for specific models sold can be compared to years past and I think many models are seeing a down trend or at least a pause in value appreciation.

The good news is it may be a good time to acquire something of interest.

Let’s look at some examples:

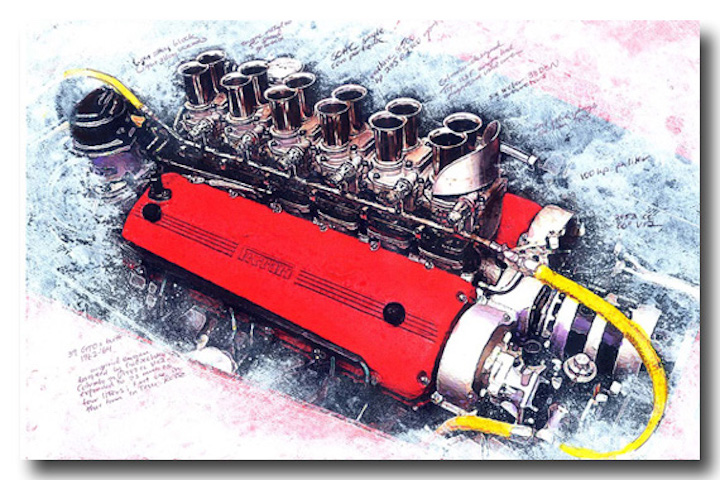

Mecum

If my math is correct the Mecum sell through rate was only 48%. This includes the sale of two out of eight (25%) of Dana and Patti Mecum’s personal cars. One of the no sales was a fifties era Ferrari 0432M race car with a high bid of $20 million (see the photo below).

Gooding

The Gooding sell through rate was 83%, the best of the four auctions covered here.

The 1980 Aston Martin V8 Volante below was sold at $162,400 well below the estimate range of $225,000 – $275,000 – Without Reserve.

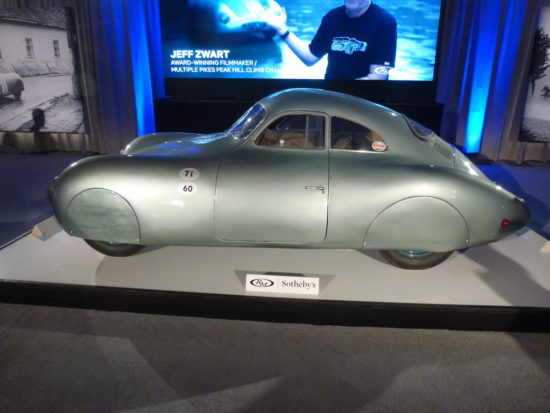

RM Sotheby’s

The RM Sotheby’s sell through rate was 73%.

This 1973 Porsche 911 Carrera RS 2.7 Touring below is still for sale.

The star of the RM Sotheby’s auction below, the 1939 Porsche Type 64, was a no sale at a high bid of $17 million.

Bonhams

The Bonhams sell through rate was 73%.

The 1989 Ferrari F40 below was a no sale with an estimate range of US$ 1,200,000 – 1,500,000.

I will write about some upside surprises in the Monterey auctions later in the week.

Let us know what you think in the Comments.

Maybe also the high estimates are not compared with the condition of the cars that are auctioned?

Sort of like the stock market, prices just can’t keep going up

I am not surprised–greater fear of recession, the strength of the U.S. dollar–(I’m a poor canadian). The ageing of

the fans of older cars–Millennials are not at all interested –probably 911’s and Japanese high performance cars will hold their own–we are seeing the larger cars pre WWII really struggling–just my opinion. Strong club and manufacture support for Porsches will help their value.

Maybe the market is running out of “soft-touch” buyers.

How many million dollar car buyers are out there?

Simon, Jim, lennox and Tom,

You all make good points. There is likely not one reason why, but for sure we are in a down turn in values for certain collector car models. However, there are some models where the values are holding firm or going up!

Markets are changed by disrupters, so I’ll pose this question. Will the car auction market be disrupted by companies like Bring a Trailer ? Is this the future of car auctions? Transporting all these cars, high commission rates, high overhead, insurance, having to wait for a specific day before the auction starts………

Mike,

I think Bring a Trailer will change the collector market sales channels. Hemmings is starting a competing on-line auction and I think these efforts will impact classic car dealers and maybe some auction companies but dealers will feel the change more.

With the big auctions there is an excitement of being there in person (selling or buying) that cannot be duplicated by an on-line auction.

There is certainly a lot of sellers who want the easiest path to selling at a fair price and that is no doubt the on-line auctions. It will be interesting to see how it all works out.

Mike

It should be noted the high proportion of No Reserve cars offered, thus guaranteeing a sale.

It would be interesting to see sell through rate with these lots omitted.

I suspect it would be very poor reading.

David